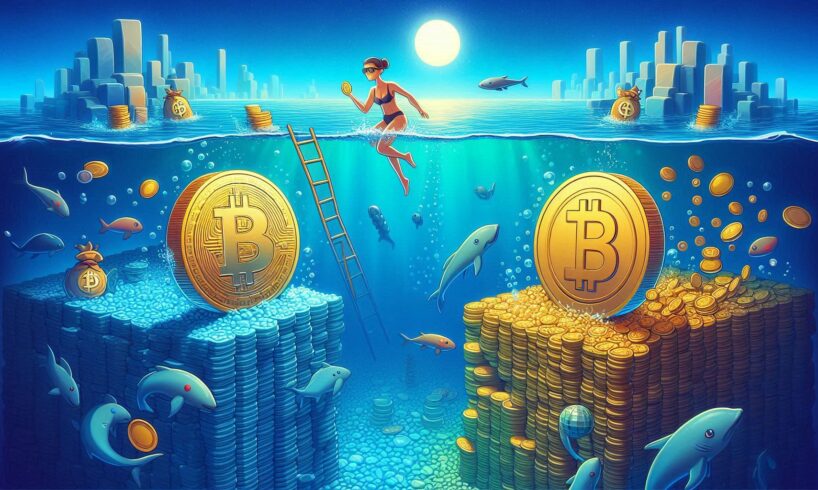

The crypto world, as such, has produced a plethora of rapidly growing innovations that can allow user’s benefits and increase their income. Among these ideas, liquidity pools and production forms now form the backbones of decentralized finance, or DeFi, an entirely new realm of financial instruments. Despite their ability to create profit for trade, they are very different in nature. This article will, therefore be on: the difference between liquidity pools and production farms, methodology, its benefits and risks and finally how they find a place in the more general crypto ecosystem.

What are liquidity pools?

Liquidity pools are actually pools of cryptocurrencies locked into a smart contract facilitating trading on decentralized exchanges, DEXs. They allow users to trade directly without needing a traditional order book and therefore provide liquidity for various trading pairs. In short, liquidity pools will allow users to exchange one token directly for another while always having enough liquidity to execute the trades smoothly.

Also Read: Crypto Pump and Dump: A Deep Dive into Market Manipulation

How do they work?

A liquidity pool follows the Automated Market Maker (AMM) protocol. Users who place deposits in a liquidity pool there then essentially become a liquidity provider or LP. For this contribution, they will receive liquidity tokens that represent their share of the pool. These can then be redeemed, at some future point in time, for their share of assets.

For example, imagine a DEX that accepts and trades the pair ETH/USDT. To seed this liquidity pool for the trading pair, LPs will pool in equal amounts of ETH and USDT. From these assets, the DEX will enable the trading while earning a fee from each transaction. These fees are divested pro rata among the LPs based on their share owned in the pool.

Advantages of Liquidity Pools

Passive Income: Transaction fees are an example of a source of passive income for LPs regarding their provision of liquidity with no active management of their investments.

Price Stability: Liquidity pools ensure that assets are free from price instability and thereby ensure volatility and slippage is less likely during a transaction

Decentralization: Since the function is to execute transactions without the influence of any central entity, the system for this crypto market enjoys decentralization and transparency.

Liquidity Pool Risks

Permanent Loss: LPs can face permanent loss when the value of the tokens that have been deposited undergoes a swing where it has relatively been valued more differently compared to when those tokens were initially deposited. This is a case where LPs withdraw their asset, which probably results in a reduced overall value if only holding tokens.

Smart Contract Risks: Given the nature of a smart contract’s implementation of Liquidity pools, there is always the bug or vulnerabilities that can lead to loss in terms of losing fund value.

Market Risk: The price of cryptocurrencies can be very volatile and, depending on the direction of the market from the time the LP positions their position, cause losses.

Production forms

Yield farming, also known as liquidity mining, is an action wherein a user locks his cryptocurrencies in some DeFi protocol to receive additional tokens as rewards. While liquidity pools are on the mission of offering liquidity in an attempt to enlarge a trading pool, yield farming tells you about lending, borrowing, and pooling assets to make more returns.

How do production forms work?

Those yield farms encourage users to add their assets to the protocol by providing incentives in the form of additional tokens, thus typically involving such forms as pools of liquidity or lending platforms to generate output for the user.

For example, a yield farmer can stake USDT in a lending process that enables others to borrow the underlying asset. Meanwhile, he is earning interest on his USDT while generating rewards on his deposited amount in the form of native tokens issued by the platform. This could theoretically lead eventually to a compounding effect whereby users earn rewards on their initial deposit amount and also on the rewards that they generate.

Benefits of production farms

Higher returns: Comparatively, the yields in yield farming are much higher than traditional savings accounts or liquidity pools because most protocols offer very attractive rewards for users.

Flexibility: Yield growers can often switch between various protocols and pools to maximize their return, and yield farmers can tactically control their investment.

Community Engagement: Most productive farming platforms have relevant communities, giving users an opportunity to get engaged, share insights, and become part of the governance.

Risks of production farms

Complexity: Production farming may be complex in many aspects and would typically require deep knowledge of many protocols as well as strategies that could be applied. Complexity can deter new users and offer the room for pitfalls.

Permanent Losses: Similar to the liquidity pools, yield farmers will also face permanent risks resulting from participation in liquidity pools as part of their strategy.

Key Difference Between Liquidity Pool and Yield Forms

Though liquidity pools and yield farms seem to be the same in their focus on delivering returns to customers, they still differ in several key aspects:

Purpose

Liquidity Pools They are designed mainly to supply liquidity for trading pairs on DEXs, which would allow users to exchange tokens without relying upon any order book.

Yield Farms They are focus on generating high returns through the encouragement of users to lock their assets into various DeFi protocols

Mechanism

Liquidity Pools: Users pool assets into a pool and earn transaction fees as a reward based on their share of the pool.

Yield Forms: Users lock their assets into various protocols and receive additional tokens as rewards, often involving more complex strategies.

Risk profiles

Liquidity Pools: At risk to permanent loss and smart contract vulnerabilities, mainly associated with price volatility of the assets within the pool.

Production Farms: Except for the platform-specific risks, the others are relatively the same, but there is a problem of multiple assets and strategies management.

return

Liquidity Pools: Returns primarily happen through transaction fees that are often more volatile but lower in general compared to productive farming.

Forms of production: Significant returns are possible in forms of production, especially when specific tokens or protocols have a high demand. However, they are also extremely volatile.

The outcome

Liquidity pools and production farms are two key elements of the dynamic decentraliz finance ecosystem. Both it plays the role of enhancing trade liquidity and yield generation for consumers. However, investors need to understand how the two concepts differ since investors rely on proper navigation of DeFi space.

More direct means of passive income generation via transaction fees, however, are the pools of liquidity. On the other side of the coin, forms of yield with more profit opportunities incur added complexity and risk. All in all, investment strategy, risk tolerance, and familiarity with the complexities of the DeFi ecosystem will determine if it is liquidity pools or production farms for the individual. Being that the defi landscape remains in constant growth and development, these tools, of course, are to become some of the front-runners of the crypto revolution, promising exciting opportunities for consumers to interact with this revolutionary financial technology.