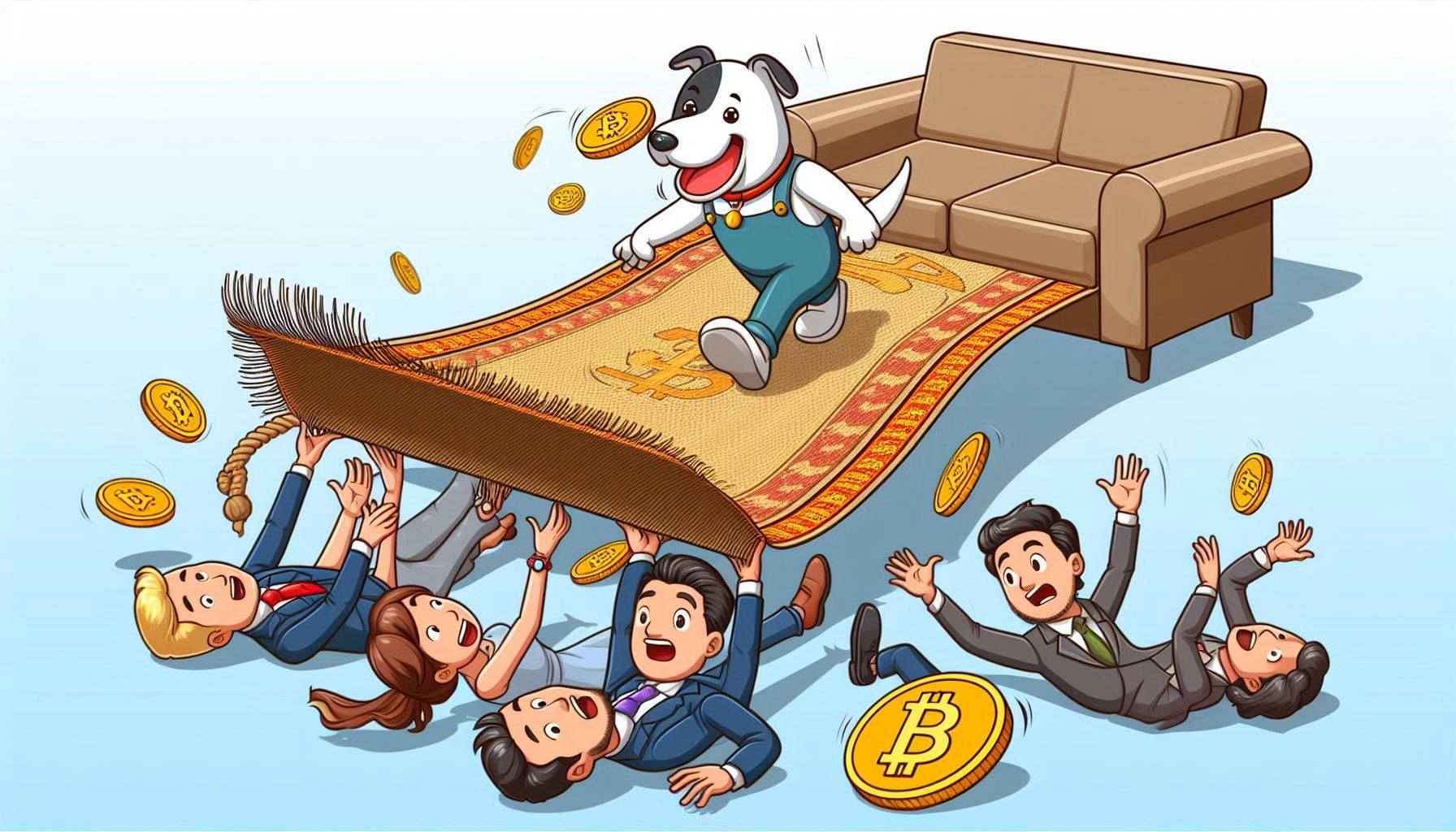

Although promising huge returns, this cryptocurrency investment carries inherent risks. The most ominous threat is a phenom called “carpet bridges.” In all practicality, this occurs when the developers or makers of the cryptocurrency project simply walks out of the project after reeling in meaningful investments. Left with useless tokens and drained funds, investors are out of luck. This has lately become a more common type of fraud-the decentralized, often anonymous nature of blockchain technology can be exploited in this manner. Prevent yourself from becoming a victim of being carpet pulled by learning more about the warning signs and red flags which characterize such scams.

What is a vein bridge?

A carpet bridge generally occurs in a number of phases:

Promising Start: The project gains publicity through social media, forums, or influencers in the processes of innovative features, potential use case scenarios, or strong community support.

Token Sale: Tokens are sold to investors in rounds of fundraising – ICOs and presales. The reason investors put money in is promises for future value and profit.

Liquidity Manipulation: The developers acquire most of the liquidity (tokens and funds) through aspects such as a liquidity pool or a centralised wallet after the token sale.

Exit Strategy: Once there is sufficient money raised or a peak with the token price. The developers execute an exit strategy. This can range from withdrawing the liquidity from the pools, selling their tokens, or simply disappearing from communication channels.

Also Read: The Importance of Interoperability in Blockchain: A Step Towards a Unified Digital Future

Red Flag Indications of potential carpet pull

Carpet pulling requires great detection and great critical analysis of the project and its developers. You can check and look into the following important indicators.

An anonymous or unverified team: This is the biggest red flag; hiding their identity or not having any credible online presence. In the first place, a legitimate project usually consists of a team of its members who are transparent and have verifiable backgrounds.

Unclear roadmap or lack of updates: A good project should have a roadmap clearly outlined with development milestones and future plans. Lack of updates, progress reports, or changes in the roadmap make your spidey senses tingle.

Toconomics and Distribution: A deeper dive on toconomics. Large allocations of tokens going to developers or the team, especially if anonymous, seems manipulation and exit strategies.

Interaction with Community and Communication: Observe how transparent and responsive the developers are in communication with the community. Vague or hazy responses to legitimate questions might indicate hidden agendas.

High Reward, Low Risk: Projects that promise very high returns with minimum risk have a high likelihood of being incorrect. Remember the rule always: “If it sounds too good to be true, it probably is.”

Precipitous launch and hype: Projects that launch quickly, precursor to hype and markets, and insufficient focus on the actual deliverables might create an environment where short-term considerations reign supreme over long-term viability. .

To Mitigate

Avoid carpet pulling by doing the following:

Deep Research: Learn as much as you can about the project team members, their previous work, etc. There are numerous reviews, audits and community feedback from trusted and not-so-trusted sources.

Verify Team Identity: Team members must have an online presence and must be reliable within the cryptocurrency ecosystem. If there is a lack of transparency it should raise instant red flags.

Verify Audit Report : Independent audits from renowned firms can give insights into the security and technicalities about vulnerabilities in the project. A project that does not allow audit or raises suspicion about reports given must be avoided.

Monitor Community Sentiment: Be part of the forums, social media groups, and platforms for discussions to monitor the community’s sentiment toward and, more importantly, discussions about your project. Keep lookout for over-the-top or manipulative narratives.

Invest in multiple projects and a variety of asset classes. Without significant diversification, a bad hit in a single area can blow a hole in your investments. Diversification, by itself, is a universal strategy that reduces investment risks.

Keep Yourself Updated and Alert: Be vigilant about the trends and developments within the cryptocurrency world. Changes in laws, and novelties.Knowledge is power in making correct investments.

Also Read: Tech Company CEO Arrested in $366 Million Crypto Scam: Unraveling the Web of Deception

Conclusion

Although crypto investments are highly profitable, having rig pulls around requires proper vigilance and caution. Avoid the situation of becoming a victim of a scam by learning how to identify signs and red flags of a rig pull. Remember, trust and transparency rule the book when it comes to cryptocurrency investments. Always check out information, get independent feedback, and so on, when assessing a new project. That way, you’ll be better alerted and informed regarding navigating the crypto landscape more safely.